New York Community Bancorp (NYCB), a financial institution facing recent challenges, has secured a significant investment of $1 billion from a consortium of investors. This capital infusion comes after a period of turbulence for NYCB, marked by a decline in stock price.

The investor group is led by Liberty Strategic Capital, a firm founded by former United States Treasury Secretary Steven Mnuchin. Mnuchin, alongside other prominent figures within the investment community, will join NYCB’s board of directors. Joseph Otting, previously Comptroller of the Currency, has also been appointed as the bank’s new Chief Executive Officer.

News of the investment bolstered NYCB’s stock price, which had plummeted following a Wall Street Journal report detailing the bank’s efforts to raise capital. The financial institution has been under pressure since late January 2024.

Analysts suggest that the investment signifies confidence in NYCB’s ability to navigate its current difficulties. The capital injection provides the bank with much-needed resources to bolster its financial position and pursue strategic initiatives.

However, the long-term success of this investment hinges on NYCB’s ability to address the underlying factors that contributed to its recent struggles. The bank must demonstrate a commitment to responsible lending practices and a focus on risk management.

Some view Joseph Otting’s appointment as CEO as a positive step. Otting’s prior experience in the financial regulatory sphere is expected to contribute to NYCB’s efforts to regain stability.

The coming months will be crucial for NYCB. The bank’s ability to effectively utilize the newly acquired capital and implement necessary reforms will determine its future trajectory.

At least 30 people have died as freezing temperatures sweep across the US, with snow, ice, power outages and travel disruptions affecting millions nationwide.

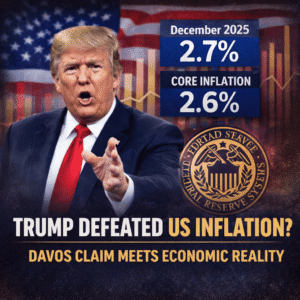

Trump defeated US inflation is the Davos claim, but US CPI still sits near 2.7%. Trump defeated US inflation faces reality as food prices, tariffs, and sticky core inflation keep pressure alive.

European Parliament freezes Mercosur deal and refers it to the EU Court of Justice, delaying ratification as lawmakers question legal basis, sustainability safeguards, and EU regulatory autonomy.

EU anti-coercion instrument is the EU’s legal tool to deter economic coercion. Learn how it’s triggered, the timeline, who decides, and what countermeasures the EU can deploy if talks fail

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message