Intel Corporation, a leading semiconductor manufacturer, has experienced a tumultuous week that has left investors and analysts questioning the company’s future direction. The week was marked by a series of events that raised concerns about Intel’s ability to compete effectively in the rapidly evolving chip industry.

One of the major developments during the week was a significant drop in Intel’s stock price. The decline was triggered by a disappointing earnings report that revealed a decline in revenue and profit. Investors were particularly concerned about Intel’s struggles in the data center market, where the company faces intense competition from rivals such as Advanced Micro Devices (AMD).

In addition to the earnings report, Intel faced criticism for its manufacturing strategy. The company has been struggling to keep up with the latest chip manufacturing technologies, which has put it at a competitive disadvantage compared to rivals like Taiwan Semiconductor Manufacturing Company (TSMC).

To address these challenges, Intel has announced plans to invest heavily in new manufacturing facilities and to outsource some of its chip production to external foundries. However, these initiatives are expected to take several years to bear fruit, and there is no guarantee they will succeed.

The uncertainty surrounding Intel’s future has led to speculation about the company’s strategic direction. Some analysts have suggested that Intel may need to consider selling off parts of its business or even exploring a merger with another company.

The wild week at Intel has highlighted the challenges facing the semiconductor industry. As the demand for chips grows, companies like Intel must invest heavily in research and development to stay competitive.

As of September 23, 2024, Intel’s stock price remains volatile. Investors are closely watching the company’s progress in implementing its turnaround strategy.

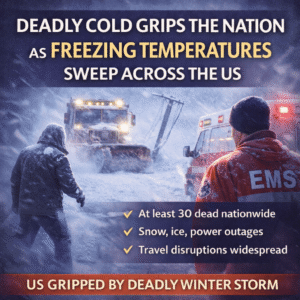

At least 30 people have died as freezing temperatures sweep across the US, with snow, ice, power outages and travel disruptions affecting millions nationwide.

Trump defeated US inflation is the Davos claim, but US CPI still sits near 2.7%. Trump defeated US inflation faces reality as food prices, tariffs, and sticky core inflation keep pressure alive.

European Parliament freezes Mercosur deal and refers it to the EU Court of Justice, delaying ratification as lawmakers question legal basis, sustainability safeguards, and EU regulatory autonomy.

EU anti-coercion instrument is the EU’s legal tool to deter economic coercion. Learn how it’s triggered, the timeline, who decides, and what countermeasures the EU can deploy if talks fail

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message