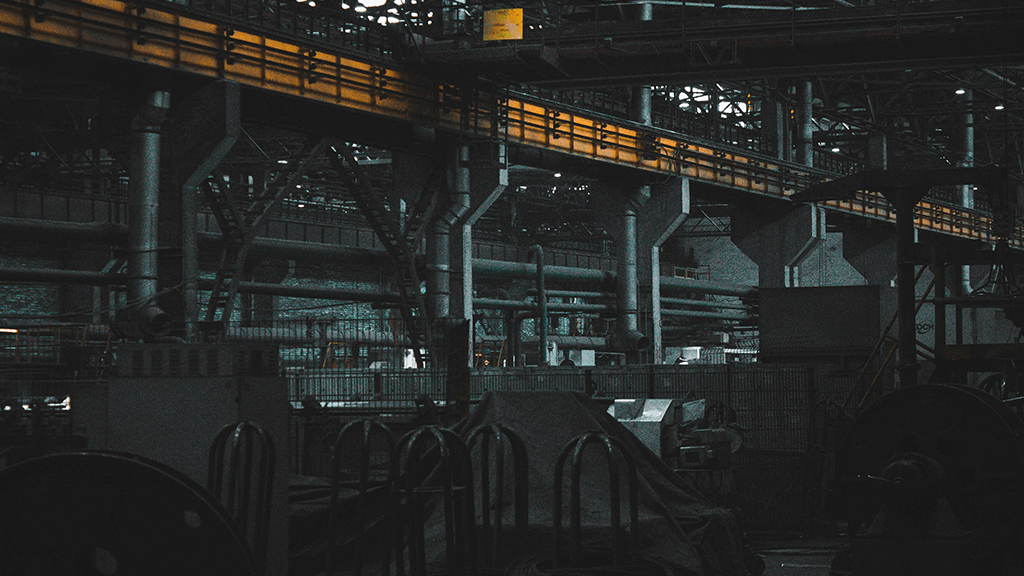

UK Manufacturing Continues to Contract as New Orders and Exports Decline

The downturn in the UK manufacturing sector has persisted for 11 consecutive months. According to S&P Global’s latest survey, the UK manufacturing continues to contract, with the August Purchasing Managers’ Index (PMI) falling to 47.0 from July’s 48.0. The PMI has remained below the neutral 50 mark since October 2023, underscoring prolonged weakness in the sector.

The contraction is driven by a sharper fall in new orders, which dropped at their steepest pace in four months. Export orders also declined significantly, attributed to sluggish global demand and persistent tariff-related pressures, especially from the U.S. and EU markets. The combination of weak client confidence and elevated input costs is limiting manufacturers’ ability to maintain consistent output.

UK manufacturing continues to contract as input inventories rise and finished goods stockpile due to soft demand. The ratio of new orders to inventory levels has deteriorated, suggesting further risks of overcapacity in the near term. Employment within the sector also declined, marking the tenth straight month of job losses, as firms scale back operations amid rising costs and falling revenues.

Despite easing inflationary pressures, input costs remain high following April’s tax increases. Although factory gate prices rose at the slowest rate in six months, manufacturers remain cautious, focusing on cost control and margin protection.

S&P revised its initial August PMI estimate of 47.3 down to 47.0, reinforcing the view that UK manufacturing continues to contract more sharply than anticipated. Meanwhile, services are showing resilience. The composite PMI, buoyed by growth in services, came in above expectations, offering some macroeconomic balance.

As the UK manufacturing continues to contract, strategic adjustments are essential. Firms should focus on export diversification, supply chain agility, and adopting automation technologies. Without fiscal intervention or a turnaround in global demand, this industrial downturn risks becoming entrenched well into 2026.

UK Manufacturing Continues to Contract as Orders and Exports Fall

EU Calls for Respect of International Law on Venezuela

EU calls for respect of international law on Venezuela as Brussels urges calm and restraint following US action, while Donald Trump offers no clear roadmap for a political transition.

Gender Pension Gap Across Europe Shows Women Retire With Significantly Less Income

The gender pension gap across Europe averages more than 20%, with women receiving far lower retirement income than men due to pay gaps,

Kazakhstan Cities Lit Orange Against Violence in National 16-Day Campaign

Kazakhstan cities lit orange against violence as Astana, Almaty and regional landmarks support the UN’s 16 Days of Activism, highlighting legal reforms

Switzerland rejects compulsory service for women and tax for the super-rich

Switzerland rejects compulsory service for women and tax for the super-rich in a decisive double referendum, voting overwhelmingly against gender-neutral national service