May 4, 2023: On Wednesday, Carmaker Stellantis posted a 14% annual increase in first-quarter net earnings as an easing of semiconductor supply chain pressures improved shipments.

The Dutch-headquartered company, which came in 2021 from the merger of Italian-American conglomerate Fiat Chrysler team and France’s PSA Group, recorded initial-quarter net revenues of 47.2 billion euros ($52 billion).

The Jeep, Dodge, and Peugeot manufacturer and other brands said consolidated shipments surged 7% from the initial quarter of 2022 to 1.48 million due to “improvement in semiconductor order fulfilment.”

“Our global footprint and diverse product portfolio state we are well-positioned to continue providing strong financial performance during the year,” Chief Financial Officer Richard Palmer stated.

The firm also initiated a 1.5 billion euro share buyback, with the first 500-million-euro tranche expected to complete in June, and stated an ordinary dividend of 1.34 euros per share would be paid to shareholders by this week.

Stellantis’ recent vehicle inventory started at 1,302 units as of the end of March. The firm indicated a return to “more average levels after a multi-year time of materially constrained supply, owed principally to unfilled semiconductor orders.”

The global car industry underwent 2022 from a scarcity of semiconductors, or chips, after years of supply chain disruptions that knocked on the worldwide economy. Therefore, these tensions have eased in recent months.

International battery and electric vehicle (BEV) sales increased 22% from the first quarter of 2022. Stellantis plans to launch nine new BEVs this year to establish a portfolio of 47 by the end of 2024.

The strong start allowed Stellantis to confirm its full-year guidance for 2023 after posting record full-year effects in 2022.

New analysis shows female employees in tech and finance AI-driven job losses could accelerate as automation targets roles dominated by women in analytics, compliance, and support functions.

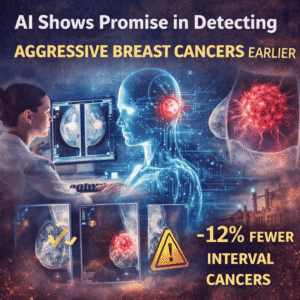

A new Swedish trial shows how AI improves early detection of aggressive breast cancers by reducing interval cancer rates and supporting radiologist decision-making in mammography screening.

Capgemini sell US subsidiary Capgemini Government Solutions after backlash over ICE-linked services, highlighting governance limits and rising ESG pressure on tech firms.

Can Europe become the new Silicon Valley? EU leaders push unified legal frameworks and innovation funding, but scale, fragmentation, and capital gaps persist.

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message