On March 25, 2024, financial services firm Oppenheimer revised its price target for Target Hospitality (NASDAQ: TH) stock from $12.00 per share to $10.00 per share. Despite this downward revision, Oppenheimer maintained its “Outperform” rating for the stock.

The adjustment reflects an updated valuation of Target Hospitality based on a multiple of enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA). Oppenheimer currently estimates Target Hospitality’s adjusted EBITDA for 2024 to be $195 million. This translates to a revised price target that implies a valuation of 5 times the company’s estimated EBITDA.

The rationale behind the price target reduction is not entirely clear. However, Oppenheimer’s continued “Outperform” rating suggests that the analysts hold a fundamentally positive view of Target Hospitality’s long-term prospects. This positive outlook may be supported by several factors, including:

While the price target was lowered, it is important to note that the “Outperform” rating indicates Oppenheimer’s belief that Target Hospitality’s stock has the potential to outperform the broader market over a specific investment horizon. Investors should consider this revised price target alongside Oppenheimer’s ongoing positive assessment when making investment decisions regarding Target Hospitality stock.

New analysis shows female employees in tech and finance AI-driven job losses could accelerate as automation targets roles dominated by women in analytics, compliance, and support functions.

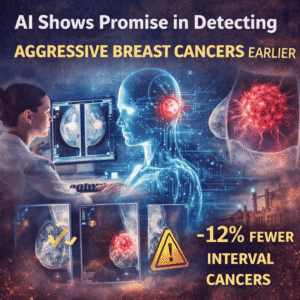

A new Swedish trial shows how AI improves early detection of aggressive breast cancers by reducing interval cancer rates and supporting radiologist decision-making in mammography screening.

Capgemini sell US subsidiary Capgemini Government Solutions after backlash over ICE-linked services, highlighting governance limits and rising ESG pressure on tech firms.

Can Europe become the new Silicon Valley? EU leaders push unified legal frameworks and innovation funding, but scale, fragmentation, and capital gaps persist.

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message