September 8, 2023: Rising fuel costs, past-peak travel demand could eat into Airlines profitability.

Jet fuel in Chicago, Los Angeles, and New York were increased over 30% with July 5, the industry group Airlines for America stated.

An increase raises queries about the amount of the increase runners have been able to pass along to clients after fares decreased from the previous year.

The higher cost forecasts reach as Southwest Airlines limited its unit revenue outlook for the current quarter. The Dallas-based carrier expected unit earnings to decreased 5% to 7% from last year in the three months ending September 30.

In July, Southwest said earnings could drop by 3% this quarter from the previous year.

“While August 2023 close-in leisure bookings were on the lower end of the Company’s expectations, modestly impacted by seasonal trends, overall leisure demand and yields continue to remain healthy,” the carrier said in a securities filing.

Southwest desires fuel to average $2.70 to $2.80 a gallon this quarter, up from its earlier estimate of $2.55 to $2.65. It maintained its forecast for capacity to rise 12% from 2022.

Other carriers warned that increased costs could affect their results.

Alaska Airlines said higher fuel prices will eat into its pretax margin this quarter.

United Airlines maintained its revenue forecast but expects fuel prices of as much as $3.05 for the quarter, up from its July estimate of no more than $2.80 a gallon.

Airlines are scheduled to report quarterly results in October.

New analysis shows female employees in tech and finance AI-driven job losses could accelerate as automation targets roles dominated by women in analytics, compliance, and support functions.

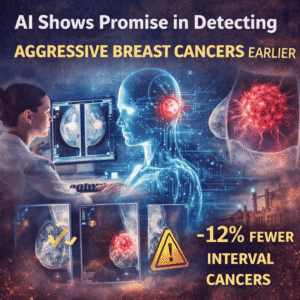

A new Swedish trial shows how AI improves early detection of aggressive breast cancers by reducing interval cancer rates and supporting radiologist decision-making in mammography screening.

Capgemini sell US subsidiary Capgemini Government Solutions after backlash over ICE-linked services, highlighting governance limits and rising ESG pressure on tech firms.

Can Europe become the new Silicon Valley? EU leaders push unified legal frameworks and innovation funding, but scale, fragmentation, and capital gaps persist.

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message