The price of Bitcoin (BTC) displayed limited volatility following the recent announcement by the Federal Reserve (Fed) to maintain current interest rates. This development contrasts some pre-announcement speculation that a Fed decision to hold rates steady could significantly impact Bitcoin’s price trajectory.

Market participants widely anticipated the Fed’s decision, unveiled on Wednesday. Furthermore, the central bank reiterated its intention to implement interest rate cuts later this year. Despite this news, Bitcoin’s price exhibited minimal movement, experiencing a slight increase followed by a corresponding dip. At this time, Bitcoin trades at around $64,250, reflecting a marginal decline from the previous day.

This muted response by Bitcoin to the Fed’s decision suggests a potential decoupling between the leading cryptocurrency and traditional financial markets, particularly regarding interest rate sensitivity. Historically, Bitcoin’s price has exhibited some correlation with broader market movements, including fluctuations in interest rates. However, this recent episode suggests a growing maturity within the cryptocurrency market, with Bitcoin’s price potentially driven by factors beyond traditional economic indicators.

Analysts attribute this muted response to several potential factors. Firstly, the Fed’s decision to maintain rates was largely expected, and the market had already priced this outcome into Bitcoin’s value. Secondly, Bitcoin’s recent price decline, which saw it fall from an all-time high of $73,737 just days ago, may have already factored in potential interest rate scenarios.

Looking ahead, the future trajectory of Bitcoin’s price will likely be influenced by a confluence of factors. These include developments within the broader cryptocurrency ecosystem, regulatory decisions from global authorities, and ongoing institutional adoption of digital assets. While the Fed’s interest rate decisions may have some influence, they may not be the sole determinant of Bitcoin’s price movement as the cryptocurrency market continues evolving.

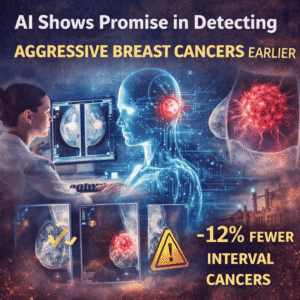

A new Swedish trial shows how AI improves early detection of aggressive breast cancers by reducing interval cancer rates and supporting radiologist decision-making in mammography screening.

Capgemini sell US subsidiary Capgemini Government Solutions after backlash over ICE-linked services, highlighting governance limits and rising ESG pressure on tech firms.

Can Europe become the new Silicon Valley? EU leaders push unified legal frameworks and innovation funding, but scale, fragmentation, and capital gaps persist.

Mario Draghi warns the EU genuine federation model is essential to stop deindustrialisation, protect industry, and prevent Europe’s economic and geopolitical decline.

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message