New analysis suggests that female employees in tech and finance are likely to experience AI-driven job losses at a rate that outpaces those affecting men, not because of biased algorithms, but because of how work itself is structured in these industries. As artificial intelligence becomes embedded across corporate functions, the impact is falling unevenly on roles where women are disproportionately employed.

In both sectors, women tend to cluster in positions focused on documentation, process management, reporting, compliance, and customer-facing operations. These roles rely heavily on pattern recognition, structured data, and repeatable decision rules—exactly the tasks AI systems are now performing with increasing efficiency. As a result, female employees in tech and finance are facing AI-driven job losses, which are emerging as a foreseeable outcome of current automation strategies.

In finance, women are far more likely to work in middle- and back-office functions than on trading desks, in quantitative research, or in senior investment roles. AI tools now handle transaction monitoring, risk reporting, and regulatory documentation at scale, reducing the need for human oversight in many cases. In technology firms, women remain underrepresented in infrastructure engineering, AI model development, and systems architecture—areas that are expanding, not shrinking.

Career trajectory plays a role as well. Promotion pathways for women in tech and finance often narrow before reaching senior operational or profit-owning positions. When automation pressures increase, roles without clear revenue accountability or strategic ownership are more vulnerable to elimination. That structural reality intensifies AI-driven job losses for female employees in tech and finance, especially at mid-career levels.

Evidence of this shift is already visible. Banks and large technology companies have begun consolidating teams after deploying AI in fraud detection, coding support, financial analysis, and customer service. While firms often describe these changes as productivity gains, headcount reductions typically follow once systems stabilize. Women, concentrated in roles categorized as “support,” are disproportionately affected.

This trajectory is not fixed. One underutilized response is to redirect women into AI-adjacent roles that remain difficult to automate. Data governance, model risk management, regulatory oversight, cybersecurity, and ethical AI supervision all require human judgment, domain expertise, and accountability. These functions are growing as AI systems become more complex and more regulated.

Internal mobility is another lever. Companies that analyze AI exposure at the task level—rather than by job title—can identify at-risk roles earlier and retrain employees before displacement occurs. Introducing gender impact assessments into AI deployment decisions would also make female employees in tech and finance who are at risk of AI-driven job losses visible before restructuring decisions are finalized.

Longer-term solutions demand structural reform. Expanding access to advanced technical training, adjusting promotion metrics to reward strategic contribution, and linking executive incentives to responsible workforce transitions could change who bears the cost of automation.

If ignored, AI adoption risks widening existing gender gaps in pay, leadership, and job security. If managed deliberately, it could instead redistribute opportunity. How organisations respond now will determine whether female employees in tech and finance AI-driven job losses become an accepted outcome—or a preventable one.

New analysis shows female employees in tech and finance AI-driven job losses could accelerate as automation targets roles dominated by women in analytics, compliance, and support functions.

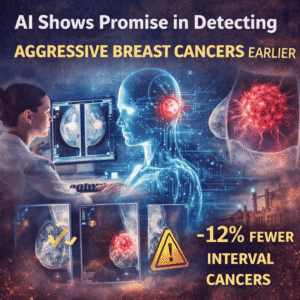

A new Swedish trial shows how AI improves early detection of aggressive breast cancers by reducing interval cancer rates and supporting radiologist decision-making in mammography screening.

Capgemini sell US subsidiary Capgemini Government Solutions after backlash over ICE-linked services, highlighting governance limits and rising ESG pressure on tech firms.

Can Europe become the new Silicon Valley? EU leaders push unified legal frameworks and innovation funding, but scale, fragmentation, and capital gaps persist.

Subscribe

Fill the form our team will contact you

Advertise with us

Fill the form our team will contact you

Leave us a message