Sterling Falls as Slower Wage Growth Fuels Bank of England

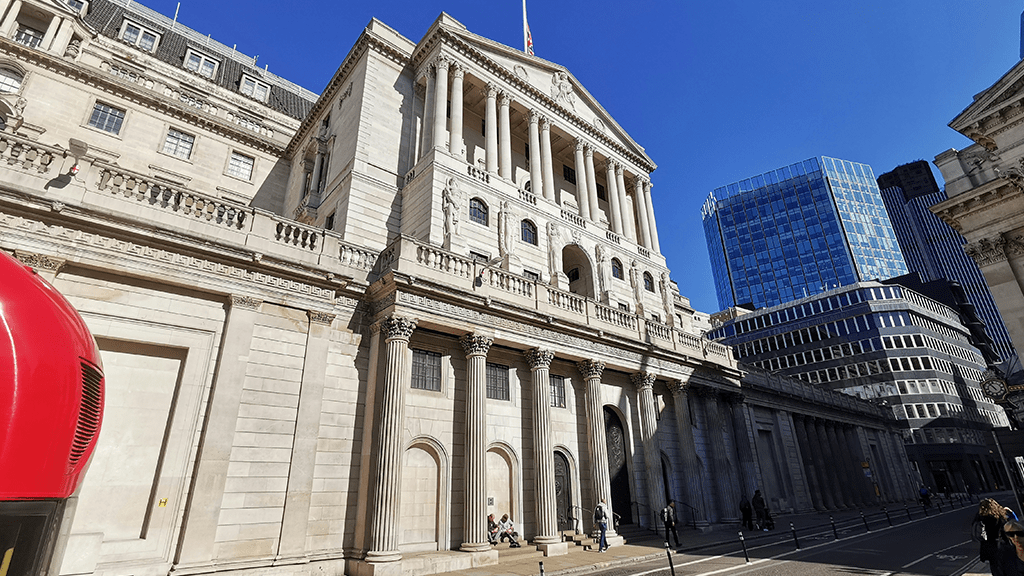

The British pound declined sharply on Tuesday as investors reacted to data revealing slower wage growth across the UK labor market. The figures reinforced speculation that the Bank of England (BoE) could move toward cutting interest rates sooner than expected, amid growing concerns about a cooling economy.

Average weekly earnings excluding bonuses rose 4.7% in the three months to August — the weakest pace since mid-2022. Private sector pay growth slipped to 4.4%, while the unemployment rate edged up to 4.8%, indicating that labor market resilience is fading. The news sent sterling down by nearly 0.5% to $1.3279, with losses also recorded against the euro.

The latest figures mark a turning point for wage dynamics that have remained stubbornly high throughout the inflation crisis. Economists say this slower wage growth could give policymakers at the BoE the cover they need to begin rate cuts as early as December.

Monetary Policy Outlook

Market pricing now reflects an almost 40% probability of a December rate cut, with traders increasingly expecting easing to begin by early 2026 if wage moderation continues. Yields on 10-year gilts slipped after the data release, reflecting shifting expectations toward a softer policy stance.

However, some analysts caution that the slowdown may not be enough to justify aggressive easing. Public-sector pay remains elevated, keeping inflationary pressures alive, while employment levels have not yet shown signs of a broad collapse.

Economist Sanjay Raja of Deutsche Bank noted that the slower wage growth offers “ammunition for the dovish camp” at the BoE, but warned that the central bank must avoid moving too quickly.

Risks and Policy Balance

The BoE now faces a delicate balancing act: cut rates too soon, and inflation risks re-emerge; wait too long, and growth could stall. A data-driven approach is likely, with policymakers relying on upcoming inflation, GDP, and employment figures to guide the next steps.

For now, slower wage growth has reshaped the outlook for sterling and placed the UK’s monetary policy path firmly under global scrutiny.

Sterling Falls as Slower Wage Growth Fuels Bank of England

UK Government to Adjust Planning Overhaul to Boost Growth

he government is refining the UK planning overhaul to stimulate growth by curbing legal delays, limiting council vetoes

Sterling Falls as Slower Wage Growth Fuels Bank of England

The pound weakened after UK data showed slower wage growth, raising expectations of an early Bank of England rate cut

Five Eyes Ministers Unite Against People Smugglers

Five Eyes Ministers unite against people smugglers in London, announcing coordinated action on border security, asylum processing, and transnational trafficking disruption.

Eurozone Inflation Inches Up to 2.1% in August

Eurozone inflation inches up to 2.1% in August, driven by food and services, while core inflation holds steady at 2.3%, keeping ECB policy on pause.